hey, i’m mohit sharma. today, i trade markets full-time—but my journey didn’t start with candlestick charts or complex strategies. it started in an engineering classroom, took a detour through dropshipping, and eventually led me to the stock market.

here’s my story.

early days: discovering tech and curiosity

my journey with building things didn’t start in college—it started way earlier. between 6th to 10th grade, i ran a tech blog called gadgetallaround, where i shared updates about gadgets, tech hacks, and everything i was excited about in the digital world.

that blog was where i first learned html, css, and basic javascript. i used a lot of jQuery snippets to add interactive elements, tweak layouts, and bring the site to life. that experience got me curious about how things worked under the hood—and it was the first time i truly got into coding. i didn’t realize it back then, but that’s where my love for building digital things really began.

engineering days & the first leap

i graduated in engineering, but i always felt i wasn’t built for the traditional path. i was more interested in testing ideas, running experiments (outside the lab), and chasing independence.

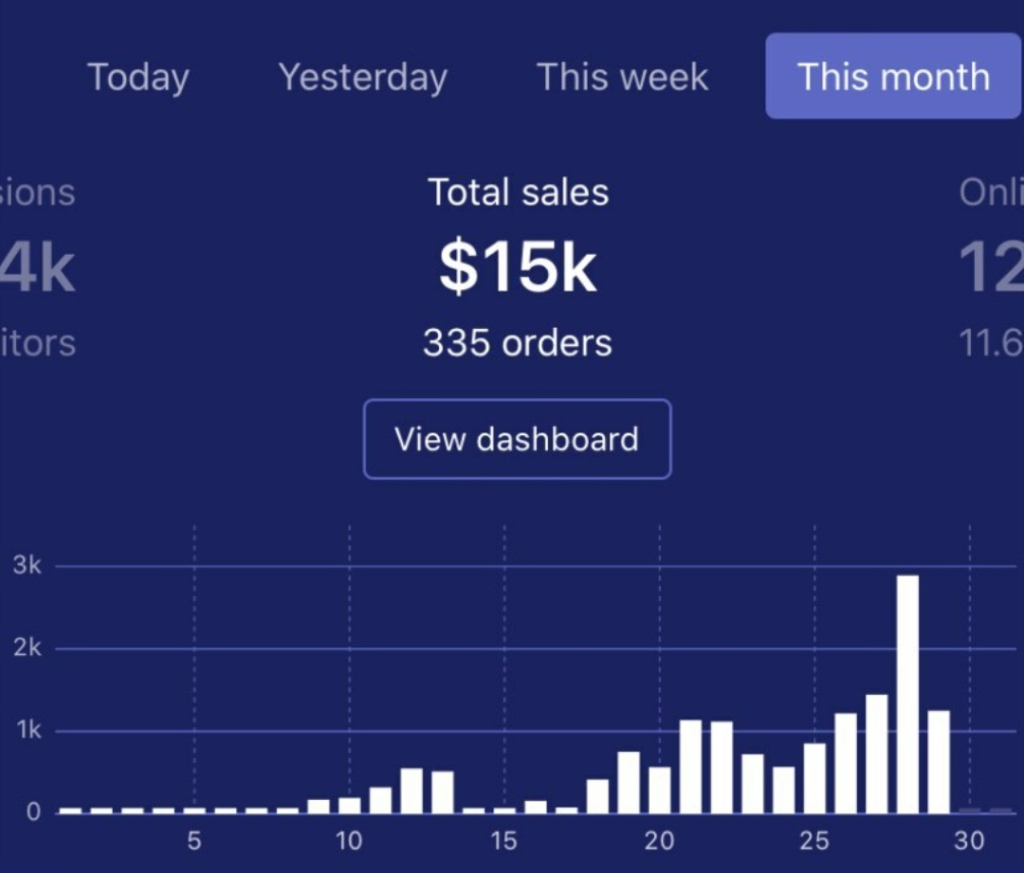

during college, i discovered dropshipping—a business model that lets you sell products online without holding inventory. i started with zero experience, built a store, learned facebook ads, and tested dozens of products.

it was messy. some products flopped. some campaigns bled money. but it taught me two things:

- how to sell.

- how to take calculated risks.

i made decent money, enough to know that i didn’t need a 9-to-5 to survive.

stumbling into the stock market

while i was running my dropshipping store, i began hearing more about the stock market—people talking about options, swing trades, long-term investing. my curiosity kicked in again. i had no finance background, but i dove headfirst into research.

i watched hours of youtube videos. i followed traders on twitter. i read every book i could get my hands on. i started trading.

and just like dropshipping, i lost money in the beginning.

painful losses, valuable lessons

early on, i made every mistake in the book—no stop-loss, revenge trading, position sizing errors. i’d win one day, lose double the next. but i was used to chaos thanks to dropshipping, and i knew how to learn from failure.

so i did what i always do:

- i built systems.

- i tracked results.

- i studied my behavior.

i learned that trading is more psychological than analytical. and i realized the importance of rules and discipline over predictions and hype.

systematic trading: my turning point

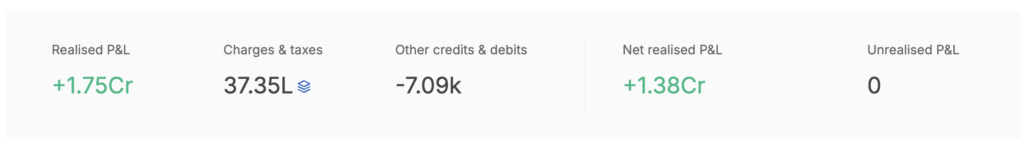

eventually, i shifted from emotional, discretionary trading to a rule-based, systematic approach. i built my own screeners, defined my entry/exit criteria, and followed strict risk management.

what changed:

- i stopped overtrading.

- i aimed for consistency, not home runs.

- i reviewed trades weekly and monthly.

- i focused on momentum and breakout setups with tight risk control.

this structure was the same mindset i used to optimize my dropshipping funnels—test, iterate, improve.

going full-time

as my edge sharpened and results improved, i made the decision to go full-time into trading. i shut down my dropshipping store and went all-in on markets. this wasn’t overnight. it took years of losing, journaling, backtesting, and learning.

but i don’t regret a thing.

final thoughts

if you’re reading this wondering whether you can make a similar shift—know this:

yes, you can.

but it’s not passive. it’s not quick.

it’s a grind, just like building any real skill.

running gadgetallaround gave me my first taste of web tinkering and coding with jQuery.

dropshipping gave me the entrepreneurial mindset.

trading gave me the financial discipline.

together, they built the version of me you see today.

thanks for reading. if you want to follow my journey, my thoughts, and what i’m building next—you’re in the right place.